Share This Page

Share This Page| Home | | Articles | |  |  |  Share This Page Share This Page |

Ignorance is knowledge — or is it the other way around?

Copyright © 2012, P. LutusUpdated 02/02/2012

(double-click any word to see its definition)

Dictionary : "A dictionary is a list of word definitions."While reading and posting in social media, mostly in scientific and technical forums, I find out what most people know about the world around them, and I have to say I'm astonished by what people don't know. Here are a few examples:

Mount Rushmore is an iconic mountain in South Dakota that has images of presidents carved in it. According to rangers at the mountain, here's the most common question: "Is that a natural formation?"

Jazzman Dave Brubeck tells us that a common question asked by fans is, "How many musicians are in your quartet?"

In the 1980s, interviewers asked fresh Harvard graduates what causes the seasons. The majority replied that summertime is caused by the earth being closer to the sun in June than in December. Australians, who experience winter weather in June, might be surprised to hear this explanation (see below for the true cause of seasons).

- When asked what is responsible for heredity, only one-third of Americans were able to identify DNA as the source.

These are just a few examples from an amazing literature of ignorance and, as the reader may be able to discern, I think some knowledge of science is essential to modern life. Based on my research and direct experience over a period of years, saying "everything you know is wrong" may seem to be exaggerated, but it's closer to the truth than most people realize. In this article I list some false beliefs people often have, followed by mini-essays about each belief. Some of the beliefs will inspire laughter, but it's my hope that all will inspire thought.

Auto Safety 1 : "When a car's speed doubles, its stopping distance does too."

(This belief appears first because it's the source of many other mistaken beliefs.)

False! Unlike an encyclopedia, a dictionary is not a repository of correct definitions, it's a record of what people believe words mean, however peculiar those beliefs might be. Here's an example — do you know what "literally" means? Most people will recognize "precise, exact, corresponding to facts" as one definition, but my readers may be surprised to discover that "figuratively" is a synonym for "literally" — only because people use "literally" that way. Here are two online dictionary definitions for "literally":

Merriam-Webster : Literally

- : in a literal sense or manner : actually <took the remark literally> <was literally insane>

- : in effect : virtually <will literally turn the world upside down to combat cruelty or injustice — Norman Cousins>

Definition (2) flatly contradicts definition (1). If a dictionary were actually a list of word definitions as most people believe, one of these definitions would have to go.

Dictionary.com : Literally

- in the literal or strict sense: What does the word mean literally?

- in a literal manner; word for word: to translate literally.

- actually; without exaggeration or inaccuracy: The city was literally destroyed.

- in effect; in substance; very nearly; virtually.

As before, definition (4) contradicts definition (1). It seems people can't agree on what "literally" means. There are many similar examples in which people use a word in a way that contradicts common sense, and dictionaries obediently record those uses. My point? That is a dictionary's purpose — to dispassionately record how people use words. Another way to put this is to say that an encyclopedia prescribes, but a dictionary describes. When an encyclopedia speaks, we listen, but when we speak, a dictionary listens.

This fact about dictionaries, unknown to most people, is the source of much confusion when trying to resolve the meaning of certain terms that do have formal meanings, meanings that should be understood by all educated people. Here's an example — what does "science" mean?

Here's an online dictionary definition for "science":

- : the state of knowing : knowledge as distinguished from ignorance or misunderstanding

- a : a department of systematized knowledge as an object of study <the science of theology>

b : something (as a sport or technique) that may be studied or learned like systematized knowledge <have it down to a science>- a : knowledge or a system of knowledge covering general truths or the operation of general laws especially as obtained and tested through scientific method

b : such knowledge or such a system of knowledge concerned with the physical world and its phenomena : natural science- : a system or method reconciling practical ends with scientific laws <cooking is both a science and an art>

This online dictionary definition accurately describes what people think science means (essentially, "knowledge"), but it fails to define science correctly, simply because most people don't know what science means. This is an example where, because of the central role of science in modern life, a dictionary definition is hopelessly misleading.

For contrast, here's a short excerpt from an encyclopedia's definition of science:

"In modern use, 'science' is a term which more often refers to a way of pursuing knowledge, and not the knowledge itself." (emphasis added)The contrast between the dictionary and encyclopedia definitions of science, only reveals that most people don't understand science. Science is not knowledge, it is a way to acquire knowledge, a set of intellectual tools that efficiently draw reliable information from nature (read more on this topic). And a typical dictionary definition couldn't be more wrong. (A more detailed discussion of science appears later in this article.)

Please remember this — to find out what a word means, don't rely on a dictionary, instead use an encyclopedia or another definitive resource. But if you want to find out what people think a word means, use a dictionary.

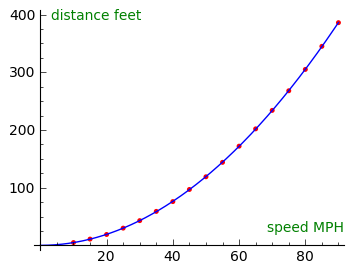

Stopping Distance Table

(reaction time not included)

| Velocity MPH | Distance Feet |

|---|---|

| 10 | 5 |

| 20 | 19 |

| 30 | 43 |

| 40 | 76 |

| 50 | 119 |

| 60 | 172 |

| 70 | 234 |

| 80 | 305 |

| 90 | 386 |

Comparison Graph

Auto Safety 2 : "Trucks require more stopping distance than cars."False! It's much worse than that, and to me, the fact that teenagers don't learn this is dangerous. Consider these points:

- A moving car has a kinetic energy $E_k$ that is equal to 1/2 its mass $m$ times the square of its velocity $v$:

(equation 1): $ \displaystyle E_k = \frac{1}{2} m v^2 $

- The distance required to bring a car to a stop is proportional to the energy computed above.

- Therefore, disregarding reaction time, the distance required to stop a car increases as the square of its velocity.

To the right is a table with some typical field-measured braking distances (from here) (remember this table doesn't include the distance required for driver reaction time, typically 1.5 seconds). Note that the braking distance for 40 MPH is 4 times the distance for 20 MPH, and the distance for 80 MPH is about 16 times that for 20 MPH, just as we would expect based on the energy equation above.

One reason experienced drivers have fewer accidents than teenagers is because they learn this braking-distance relationship through direct experience, an experience teenagers don't have yet. But worse, in most cases teenagers don't learn this braking-distance danger in school — they have to learn it the hard way, by driving experience that contradicts "common sense."

Here is a convenient equation to predict total stopping distance in feet (including a 1.5-second reaction time), using an argument of velocity in miles per hour:

(equation 2) : $ \displaystyle d = 1.5\, v \frac{5280}{3600} + \frac{v^2}{20}$The above equation shows the reaction time computation in detail — it's 1.5 seconds times the velocity which is converted to a distance (the 5280/3600 factor). Here is the same equation with the absolute minimum number of terms:

(equation 3) : $ \displaystyle d = 2.2\, v + \frac{v^2}{20}$For both equations above, the variables mean:

- v = velocity in miles per hour

- d = stopping distance in feet

Again, the above equations take a 1.5-second reaction time into account. Some drivers may think a 1.5 second reaction time is excessive, but law enforcement professionals assure us that it's typical of real-world driving experience when one includes factors such as fatigue and the distractions of a modern car.

I understand this is a lot of detail to try to remember, especially for people who don't learn very much physics or mathematics in school, so here is a concise summary — contrary to common belief, and neglecting reaction time, braking distance increases as the square of velocity, or if you double your speed, your stopping distance becomes four time greater (more details here).

Gambling : "After a long losing streak, statistics says my luck should improve."

Should not be true. It's only true because trucks are designed without adequate braking systems and computer-controlled jackknife preventers, solely for economic reasons. There's no engineering reason why a big truck could not stop as quickly as a car. And I can prove it using logic — are you ready?

- First, we have an example car that weighs four tons and has four tires. It can stop quickly and efficiently.

- Next, we have a big truck that weighs 20 tons and has 20 tires. We will prove that the truck can stop just as quickly as our car that weighs four tons and has four tires.

- How is that possible? Well, consider five such cars, driving close together, separated by only a small distance.

- Can the five cars stop quickly? Yes, of course — the individual drivers just slam on their brakes.

- Now imagine that the five cars are connected together by a solid metal bar, so they are now one long vehicle that ... get ready for it ... weighs 20 tons and has 20 tires, just like the truck.

- What has changed? If the drivers of the five cars slam on their brakes, the five cars will stop just as quickly when connected together as when they were separated, because the loading of their tires has not changed (each tire must bear one ton of weight).

- The difference between the five connected cars, and the truck, is a simple matter of shape, not tire loading — the individual cars, the joined cars, and the truck all should be able to stop in the exact same distance.

- One difference between cars and trucks is the possibility of a "jackknife," where a braking truck's trailer tries to overtake the tractor (the cab/engine part of the truck) and the truck folds up on the road. But this can be easily prevented by a computer-controlled system that automatically prevents it, if only truck manufacturers and operators would pay for the safety improvement.

- Another difference is that a braking system that's adequate to efficiently stop a truck is more expensive than an equivalent braking system on a car, and truck manufacturers are reluctant to install such brakes for purely economic reasons.

A final issue is that trucks often have higher tire loading than cars do — their tires must bear more weight than in the above example, and most people assume this affects braking efficiency. But as it happens, when you increase the loading on a tire, it presses down on the pavement with more force, and this should make the braking action more effective. So this should not prevent the truck from stopping efficiently, as long as it has an adequate braking system.

The above explains why there only needs to be one braking-distance chart for all cars, regardless of their size and weight (and assuming dry, level pavement) — the difference between car weights, tire surface areas and other factors all cancel out in the physics. The only reason this explanation doesn't apply to large trucks is because large trucks are not designed safely.

Evolution : "Natural selection represents a planned march toward higher forms of life."

False! The above false belief is called the "Gambler's Fallacy", and casinos make millions from it. This is an example where human intuition and "common sense" completely mislead many people.

There are many games of chance, and in a well-run casino most of them are perfectly fair (meaning random and unbiased), so for each game, the player has well-established odds of winning. The "Gambler's Fallacy" concerns a particular kind of natural but misleading human belief — that after a long streak of losing (or winning), the trend should reverse, and the longer the streak, the greater the likelihood of a reversal of fortune.

To show how nature contradicts this expectation, let's use the example of flipping a coin — a very simple game of chance. Let's say the coin is fair — it has an equal chance to land heads up or tails up. Now let's ask some questions about the coin:

- On the very first flip, what is the chance for heads?

- After a series of eight heads results in a row, what is the chance that the next flip will produce yet another heads result?

- After a series of eight tails results in a row, what is the chance that the next flip will produce a heads result?

Surprisingly, the answer to all the above questions is 1/2 or 50% — each flip has a 50% probability of coming up heads, regardless of what has happened before.

Doesn't this contradict statistics and probability? What's the probability of throwing eight heads in a row? Well, the answer is $2^{-8}$ or $\frac{1}{256}$. But the important thing to recognize is that this probability applies to the complete sequence of events, not the individual events:

- The probability for eight heads in a row is $2^{-8}$ or $\frac{1}{256}$.

- But the probability for heads in each flip in the sequence is $2^{-1}$ or $\frac{1}{2}$.

How can that be? How can the complete sequence be so improbable, and yet each event within the sequence be so probable? It's because the improbable sequence of eight heads outcomes is constructed from independent events each of which has a higher probability. Like this:

(equation 4) : $ \displaystyle \frac{1}{2} \times \frac{1}{2} \times \frac{1}{2} \times \frac{1}{2} \times \frac{1}{2} \times \frac{1}{2} \times \frac{1}{2} \times \frac{1}{2} = \frac{1}{256}$This is why, during the sequence, each new flip has a 50% chance to come up heads, and those odds don't change.

Since this was a bit technical, just remember that the next coin flip, or roll of the dice, or slot machine play, or spin of the roulette wheel, or game of cards, owes nothing to its past.

Symmetry : "Two wrongs don't make a right."

False! Natural selection is a completely random process that has no preferred outcome. The fact that complex species like humans have evolved over time results from chance, not a plan, and there are many much simpler organisms that are at least as successful as we are. In fact, many researchers believe the most successful species are bacteria, and they may represent more earthly biomass than all other plants and animals combined.

It's estimated that we humans have more bacterial cells within our bodies than human cells (but a much lower percentage by mass or volume).

I ask my readers to think about this — we're not a successful species because of destiny or because of a plan built into natural selection, we're successful because we happen by chance to fill an environmental niche. We're here because we successfully competed with other species, but all victories in natural selection are temporary, because nature's requirements keep changing.

Humans have existed in approximately our present form for about 250,000 years. The possibility exists that, in another 250,000 years, we may have been replaced by another species, and not necessarily a more intelligent one. For longer time periods, the probability can only increase that we will evolve away from our present form, or be replaced. And a million years from now, the probability that human beings will exist in anything like our present form is vanishingly small.

Meanwhile, a global catastrophe might come along and wipe us out (as happened to the dinosaurs). Some other species might then arise, better suited to the conditions, and wander among the artifacts of our civilization, wondering what kind of creatures we were, just as we now do with dinosaur bones.

I sometimes hear people discussing the sun's remaining lifetime (about five billion years) and how, when the sun becomes a red giant and engulfs the earth, we humans will need to move to a new planet. This is an absurd fantasy — five billion years is longer than any kind of life has existed on earth, and it's 20,000 times longer than human beings have existed. It is virtually certain that, five billion years from now, human beings will have been completely forgotten. In the sweep of billions or even millions of years, we are a small blip on nature's radar. Maybe we need to get over ourselves.

Based on the best current scientific results, the above is a reasonable summary of our earthly existence, and I'm sure some people will find it discouraging that we're not here because we deserve to be, or because of supernatural destiny. We're simply here, and "deserve" has nothing to do with it. Some of my readers may see this in a negative way, but to me, it means life is not an entitlement, but a gift. I intend to enjoy and appreciate my gift. How about you?

Advertising "Advertising is meant to inform us."

Symbiosis between Clownfish and sea anemone. The fish protects the anemone from anemone-eaters, the anemone protects the fish from fish-eaters.Nature teaches otherwise. The above saying is very commonly heard, to the degree that most of us don't think about it any more — based on how often we hear it, most people think it must be true. But as it turns out, it's not true.

When human and animal behavior is carefully examined, it turns out there are examples of reciprocity everywhere — creatures are observed engaging in what appear to be acts of altruism, but in most cases there is an expectation of reciprocity at some future time. There are even examples of symbiosis (mutually advantageous partnerships) between species as well as individuals within species — but all of them involve reciprocity, coöperation, "tit for tat".

But reciprocity doesn't just mean coöperating and sharing, it also means punishing negative behaviors when they arise. Obviously in a group or tribe, coöperative relationships arise over time based on experience and trust, but for this system to work, there must also be a way to punish cheaters, those who exploit trust but who won't reciprocate. In nature, punishment of defectors is as much a sign of reciprocity as coöperation is, and it seems that both must exist (this is called the Symmetry Principle).

This fact is well-understood by anthropologists and biologists, and as expected, one sees both kinds of reciprocity in nature — negative as well as positive reciprocity, up to and including expulsion from the group for defectors who won't change their behavior. So in nature, and in human societies, it seems two wrongs do make a right.

This truism is proven even in computer programs designed by game theorists that are meant to model societies and analyze behavior between individuals and groups. In a now-famous example, a computer game called "Prisoner's Dilemma" was used to model interactions between individuals to see which strategy was most effective. Without explaining Prisoner's Dilemma fully, even though relatively simple, in multiple rounds between individuals the game can produce complex outcomes, and much thought has gone into designing an optimal strategy.

In an organized Prisoner's Dilemma tournament, theorists were invited to submit their game strategies in the form of computer programs, and in a series of matches, the tournament would choose an overall winner — the most effective strategy. At the end of the tournament, the winner was a strategy named "tit for tat" and compared to most of the entries, it was extremely simple, only a few lines of code.

"Tit for tat" executed a very simple strategy — on the first move, it coöperated, and on all subsequent moves it duplicated the prior move of the other player. In other words, after an initial offer of coöperation, it coöperated only if the other player had coöperated, but it defected if the other player defected. By rewarding coöperation and punishing defection, "Tit for tat" perfectly reflects how individuals, groups and societies work, and in the tournament it proved to be the most effective strategy.

In summary, nature teaches us that two wrongs do make a right, but only when necessary.

Science : "Science is knowledge."

False! Advertising is meant to persuade, not inform, and it does this by appealing to emotion, not reason. Understanding how advertising works is especially important in modern times. We're bombarded by advertisements everywhere we go — online, TV, movies ("product placements" are often inserted into movie scripts), "free" computer programs that are actually a way to deliver advertising, and many others.

I personally think students should learn how to evaluate advertisements, apply critical thinking skills, as an essential modern survival strategy. Unfortunately, in most present-day schools, critical thinking is either disregarded or actively discouraged. So here are some advertising principles that people should know:

- The first principle of advertising is that, if a product appears in an advertisement, you do not need it. Things that are essential to survival are not advertised, because people don't need to be motivated to go out and get them. Advertisements describe things you might want, but you certainly don't need.

- The second principle of advertising is to make people forget the first principle — to redefine wants as needs, because wants are optional and whimsical, but needs inspire passion and purchase. You don't just want a bathroom deodorizer, you need it. You don't just want a pet rock, you need it — your life would be a barren wasteland without it.

- The third principle of advertising is to tell lies just this side of felony prosecution. Advertisers learn how to walk the delicate line between simple lies and jail sentences.

- The fourth principle of advertising is to push the meta-product — not a specific product, but the idea that buying products makes the purchaser a better person, a participant in modern life, a contributor to economic growth, a patriot. This principle is actually more important than any of the others, because though it doesn't sell a particular product to the consumer, it sells the consumer to the product.

The cynicism of advertisers is boundless. Shortly after the 9/11 terrorist attacks, I noticed a barrage of TV ads that delivered the same basic message — if you don't go out and buy a new car, the terrorists win.

In advertising, nothing is left to chance — every word, every posture, every image, every appeal is subjected to careful scrutiny and audience testing. And because of their importance to all kinds of advertising, words get particular attention. The words in advertising are chosen to sound like they're providing information, but without actually saying anything meaningful or making a tangible claim that might lead to legal action.

For example, food advertising uses words that sound reasonable but that convey no meaning whatsoever. Words like "hearty", "zesty", and "spicy" are particular favorites, because they have no generally agreed meaning, so they are safe — no one can accuse the advertiser of misleading them. This may come as a surprise, but zest is not a vitamin and the FDA doesn't have a published requirement for minimum zestiness.

Another favorite advertising word is one that suggests the presence of something, but the word's presence confesses the absence of what it describes. My favorite in this class is "chocolaty" — contrary to what many people believe, "chocolaty" means there's no chocolate. "Lemony" is a similar word with a similar purpose — it's used to describe a product that contains no actual lemon.

Big Pharma

But for cynicism and predatory behavior, food advertisers can't compare to Big Pharma (a brotherhood of large, multinational pharmaceutical companies). While a food company might create a bogus junk food product and sell it using bogus words, Big Pharma will create a bogus disease, offer bogus drugs as treatment, then create bogus research to defend its product. I wish it were not so, but this isn't even slightly exaggerated.

Consider depression as just one example. Depression might actually be a disease, but there's no present scientific evidence for a cause, and contrary to what one reads in the press, there's certainly no scientific evidence for effective treatment either.

But none of the above stands in the way of Big Pharma, which has fabricated the idea that depression is a disease, and that drugs and therapy represent a treatment. Big Pharma does this by ... there's no other way to put it ... lying through their teeth, paying off unethical researchers to churn out bogus "scientific" results, paying physicians to prescribe their drugs, and creating advertising campaigns that distort the scientific record:

- FDA finds U.S. drug research firm faked documents : "... in at least 1,900 instances between April 2005 and June 2009, laboratory technicians identified as conducting certain studies were not actually present at Cetero facilities at that time."

- A New Low in Drug Research: 21 Fabricated Studies : "A prominent Massachusetts anesthesiologist allegedly fabricated 21 medical studies involving major drugs ... Some of the studies reported favorable results from use of Pfizer’s Bextra and Merck’s Vioxx, both painkillers that have since been pulled from the market."

- Drug Maker Is Accused of Fraud : "... federal prosecutors alleged that former top executives at Forest concealed for several years a clinical study that showed that the drugs were not effective in children and might even pose risks to them, including causing some to become suicidal."

Faced with a blizzard of accounts like the above, aware that drug companies routinely throw away studies that make their drugs look bad, and realizing this misleads the public about the value of anti-depression drugs, the FDA recently organized a special study that combined the results of published and unpublished studies of depression drugs, and drew this conclusion: "The purpose of this analysis is to establish the relation of baseline severity and anti-depressant efficacy using a relevant dataset of published and unpublished clinical trials ... when unpublished trial data are included, the benefit falls below accepted criteria for clinical significance." For those unaccustomed to reading technical results, this study shows that, contrary to aggressive advertising claims, there is no scientific evidence that anti-depression drugs actually work for the majority of patients.

Now we turn to therapy, the other part of the "treatment" — does psychological therapy actually work for depression? The best evidence says that, although talking to someone is helpful, it doesn't need to be a specialist, just a sympathetic listener. This study arrived at this conclusion: "The results of this study fail to support the superiority of CT [cognitive-behavioral therapy] for depression. On the contrary, these results support the conclusion that all bona fide psychological treatments for depression are equally efficacious." This study seems to say that, even though no specific variety of psychological help is better than any other, one still needs to consult a mental health professional.

Another study is more discouraging about the effectiveness of talk therapy for depression. It says "... the specificity of CBT [Cognitive-Behavioral Therapy] and IPT [Interpersonal Therapy] treatments for depression has yet to be demonstrated." In other words, these therapies have no established effectiveness against depression.

And in this study, the efficacy of all talk therapies is called into question : "... the uniform efficacy of psychotherapeutic treatments with adults does not provide any evidence that the null hypothesis is false." Translated into English, this study shows that the idea that these therapies don't work (i.e. the null hypothesis) has yet to be contradicted with plausible evidence that they do. (The null hypothesis is a scientist's default position toward a theory — he assumes it to be false unless there is contrary evidence.)

An explanatory note for nonscientists — why does the fact that all these therapies seem to work equally well, lead the above researchers to the conclusion that they might not work at all? The answer is something called the Placebo Effect, a well-documented phenomenon in which a treatment of no real benefit is applied and seems to work. The Placebo Effect has been studied extensively and it seems that, in many cases, any treatment, even a sugar pill, seems to produce positive results. This effect is so well-established that when researchers are confronted by patients who report positive results no matter what treatment is offered, they realize it may be a case of the Placebo Effect — the patient thinks he should be getting better, so he does, but this is a psychological change, not one created by treatment.

The conclusion of these studies is that, contrary to what Big Pharma wants the public to believe, there is no scientific evidence that drugs work for depression, and there is no scientific evidence that therapy works either. This leads to the possibility that depression isn't actually a disease at all, but a modern invention to justify bogus treatments and enrich Big Pharma's stockholders.

To summarize, depression might actually be a disease, but there is no basis in science that drugs work, and there is no basis in science that therapy works. At the moment, with our limited scientific understanding, depression may be an invented disease, a cynical, ingenious marketing campaign in which Big Pharma first invents the disease, then invents the patients, and then invents the treatments.

In case the above got too complicated, this is how an invented disease works:

- Q: What are depression drugs? A: They're drugs designed to treat a disease called depression.

- Q: But is depression really a disease? A: Yes! The proof is that there's a treatment — depression drugs.

- Q: But do those drugs actually work? A: Yes — most people who take our drugs report a positive outcome.

- Q: What about the studies that reported null or negative results? A: Those studies weren't published in scientific journals, so they don't count.

The above "logic" is why the FDA performed its meta-analysis that included completed but unpublished studies, and that concluded that there is no clinically significant benefit from these drugs and therefore there is reasonable doubt that depression is even a disease..

Now that's real advertising! In simple advertising, there's a problem, a product that solves the problem, and a customer who might buy the product. All the advertiser has to do is write an advertisement to attract the customer to the product. But in Big Pharma advertising, a drug company invents a problem to be solved (a "disease" called depression), creates a "cure" (drugs), then attracts patients to the cure by paying doctors to prescribe the drugs. To put this another way, simple advertising sells a product to a customer, but Big Pharma advertising sells a customer to a product.

I close this section by highly recommending a terrific book on the topic of depression, psychotherapy and Big Pharma: "Manufacturing Depression" by psychotherapist Gary Greenberg. Greenberg arrives at many of the same conclusions I do, but with much more detail and literature references.

Seasons : "The seasons are caused by the earth's changing distance from the sun."

False! A typical dictionary will define science as knowledge, but for reasons given earlier, dictionaries cannot be relied on to provide technically accurate definitions. A dictionary's purpose is not to say what a word means, but report what people think a word means. And people think science means knowledge.

But contrary to common belief, science is correctly defined as the process by which we find things out, the intellectual tools we bring to bear on unanswered questions. A scientific investigation includes these basic elements:

- Observation and description of phenomena.

- Shaping of a theory that explains and generalizes the original observations.

- Tests of the theory in other domains, to validate or falsify it.

- A willingness to discard falsified theories.

The last point is by far the most important — a theory that cannot be tested or potentially falsified is unscientific on that basis alone. Science's highest level of certainty is a tested theory, and scientific theories are always open to new tests and potential falsifications. There are many stories in science where a theory that had stood for centuries was suddenly falsified by new evidence and replaced by a better theory.

The above may seen confusing to a reader of the popular science press, where terms like "scientific fact" and "scientific law" are seen regularly. But unlike science journalism, in science there are no scientific laws on the ground that a law cannot be challenged, only obeyed, and a "scientific fact" is an expression that seems to place a statement beyond challenge. In science, nothing is beyond challenge.

The fact that scientific theories never become laws and are perpetually open to falsification was best expressed by philosopher David Hume, who said, "No amount of observations of white swans can allow the inference that all swans are white, but the observation of a single black swan is sufficient to refute that conclusion." Readers should remember this when they hear someone describe a scientific theory as "just a theory" — a scientific theory is much more than just a hunch.

The other source of public confusion about science is the role of authority and expertise. In most parts of life, authority and expertise carry weight, but in science, only evidence has weight, nothing else. Among laymen, there is often a confused kind of reverence toward scientists, but among scientists themselves, this doesn't exist — only skepticism toward anything but direct evidence. A scientist's attitude toward scientific authority is best expressed by the motto of the British Royal Society, possibly the oldest professional organization of scientists in the world (founded in 1660). The motto is "Nullius in verba" or "Take nobody's word for it."

Another important property of science is skepticism toward claims unaccompanied by evidence. This default scientific posture is called the Null Hypothesis — the assumption that a claim is false unless and until there is supporting evidence. To a layman this posture may seem overly skeptical at first, but think about it — without the Null Hypothesis, Bigfoot, the Loch Ness Monster and alien visitations would all be assumed to be true unless they were proven false, and none of them can be conclusively proven false (a requirement for negative proof is a logical error called argumentum ad ignorantiam).

The presence of the Null Hypothesis is a useful way to detect a crackpot:

When a scientist has an idea, he assumes it's false unless and until there is evidence (Null Hypothesis) and he understands that the burden is his alone to produce evidence.

When a crackpot has an idea, he assumes it's true without evidence, and instead of seeking evidence for his idea, he tries to shift the burden of evidence onto others to prove it false, which they cannot do for reasons given above.

This partly explains why people believe so many weird things — they just don't understand how to process evidence, or even understand its role. This problem might be alleviated by teaching science in school, unfortunately science education is hugely controversial in public schools, despite the fact that science is the engine of the modern world.

Psychology/Psychiatry : "Human psychology is a science."False! This is a surprisingly common belief, even among Harvard graduates (in a now-famous set of interviews). Most people believe some version of the idea that summer weather is caused by the the earth being closer to the sun in June than in December. But people in Australia experience summer in December and winter in June — what gives?

Here's what gives:

The earth's orbit and seasons (earth and sun not remotely to scale)

- The earth's distance from the sun changes very little during the year, so this cannot be the cause of seasonal temperature changes.

- The earth's rotational axis is tilted with respect to its orbit, by about 24 degrees.

- As a result, as the earth orbits the sun, the sun appears higher in the northern hemisphere sky in June, and higher in the southern hemisphere sky in December.

- This is the cause of the seasons — the northern hemisphere gets more sunlight in June, and the southern hemisphere gets more sunlight in December.

- Australia's seasons are the reverse of those in the northern hemisphere — Australia's summer is in December and winter is in June.

- This apparent solar position change is most dramatic at the north and south poles.

- At the north pole, on about June 21st, the sun remains about 24 degrees above the horizon, rotating horizontally through all compass headings.

- Between June 21st and September 21st, the sun slowly descends toward the horizon, while still rotating horizontally.

- After September 21st, the sun remains below the horizon for six months until about March 21st, when it rises again.

- At the south pole, the sequence is reversed — the sun is highest in the sky on December 21st and sets on March 21st for six months.

Education : "A college education pays for itself."

False! Although psychology (meaning human psychology) bears a superficial resemblance to science, and even though there are scientists performing research within psychology, the field has yet to meet an essential requirement that separates science from philosophy — a central core of testable, potentially falsifiable theory.

Some of my readers may wonder how a field with scientists actively doing research could be thought of as anything but a science. The answer lies with the nature of the research. To make this point, I once performed a toy astrology study that measured how many of each astrological sign there are in the population. My study was perfectly legitimate science — it processed field data and arrived at a conclusion about astrology that would be useful to astrologers in their work. But could my scientific astrology study make astrology scientific? No, for the reason that it didn't address or test any of astrology's theories.

Scientific fields are defined by their theories — for example, biological theory asserts that evolution and natural selection explain the living natural world, and all research within biology addresses those theories, either directly or indirectly. If a new finding were to contradict prevailing theory, biologists would be obliged to revise or abandon it. In science, in the extreme case where a theory is entirely falsified and no new theory is available, an entire field is sometimes abandoned, as with alchemy (replaced by chemistry in the late 17th century). This is the central role played by theory in science — theories define scientific fields, and all theories must be potentially falsifiable in practical experiments.

The reason psychology lies outside the realm of science is because it doesn't have clearly stated theories that unify and define the field, and that can be tested and potentially falsified in experiments. This means that, no matter how much legitimate science is performed within psychology, because that research doesn't test the field's defining theories, it cannot turn psychology into a science, any more than my toy astrology study could turn astrology into a science.

Also, there is the problem that different branches of psychology disagree about what their field means, a failing that psychology shares with astrology. Because two important groups both define themselves as psychologists but disagree about how the field should be defined, this represents a serious obstacle to legitimizing the field as science. As it happens, clinical psychology and psychiatry are both subfields of psychology, but they openly disagree about the meaning of psychology, they have separate publications and conferences, and they mutually and openly argue that the other subfield is neither real psychology nor science. Unfortunately, because of the lack of testable theory within the field, such schisms cannot be resolved using science or evidence.

Another danger sign is the popularity of unscientific fads within psychology. We're just seeing the discarding of one fad — Asperger syndrome — which was legitimized by its inclusion in psychology's standard diagnostic manual (the DSM), but because of vague diagnostic criteria and a lack of science, became wildly popular and resulted in an epidemic of diagnoses, few of which had any connection with real mental illness. In the face of an epidemic of overdiagnosis it became obvious to those behind Asperger's that they had made a mistake, and they are now moving to remove Asperger's from the DSM, primarily in order to stem the tide of nonsense diagnoses of young people. The point I am making here is that Asperger's was being diagnosed and "treated" before being studied scientifically, to establish whether there is actually a distinct mental illness with that name.

The Asperger's story follows on the heels of another similar story, one with much worse consequences, called "Recovered Memory Therapy", in the 1990s. In "Recovered Memory Therapy", clients were encouraged to "remember" buried memories, on the theory that memories of particularly traumatic events would be suppressed, and could only be recovered with professional assistance. This fad resulted in many false prosecutions of innocent people who were charged with imaginary crimes, usually sexual in nature, and many lives were ruined before — as with Asperger's — the practice was stopped.

There are many similar stories about psychology, going back for decades, each of which seemed to be a breakthrough in the treatment of mental illness, but each of which was eventually abandoned after it proved to be ineffective, or injured clients or the field of psychology, or both.

But there's light at the end of the tunnel. There is a different field, a scientific field, called "neuroscience," with no connection to psychology, that makes different assumptions and focuses its attention on the brain and nervous system instead of the "mind" (a philosophical abstraction). Because neuroscience addresses the brain instead of the mind, there is much less pseudoscience present. Neuroscience is experiencing rapid growth right now, fueled by an increased respect for science and evidence, as well as the availability of new research tools like whole-body scanners.

Many influential mental health professionals have begun to campaign for a shift away from psychology/psychiatry toward neuroscience, including the present director of the National Institutes of Mental Health, who in a recent Scientific American article says "In most areas of medicine, doctors have historically tried to glean something about the underlying cause of a patient’s illness before figuring out a treatment that addresses the source of the problem. When it came to mental or behavioral disorders in the past, however, no physical cause was detectable so the problem was long assumed by doctors to be solely 'mental,' and psychological therapies followed suit. Today scientific approaches based on modern biology, neuroscience and genomics are replacing nearly a century of purely psychological theories, yielding new approaches to the treatment of mental illnesses."

But this change doesn't mean the end of psychiatry and psychology, any more than the development of astronomy ended the practice of astrology, or the development of chemistry ended the practice of alchemy. The reason? There will always be weak-minded people who simply do not care whether what they're doing has any connection with science or evidence. For those people, psychiatry and psychology will remain available.

(Read more on this topic here.)

Investment : "Investment advisors are worth every penny."

Not necessarily! The conventional wisdom was that a college graduate would be more successful and have a higher income than a non-graduate, but changes in both higher education and the workplace have begun to call this idea into question.

One change is the rapidly increasing cost of higher education, which is now increasing at about 8% per year — faster than any other household expense. At that rate of increase, college costs double every nine years. But according to this source, while college costs continue to rise, since 2000, college graduate income has declined in real terms. This is a trend that cannot continue — a college degree simply won't be worth its cost.

This source shows that in 2010, the average college student graduated with a debt of about $25,250 and faced a new-graduate unemployment rate of 9.1%, only 1/2 percentage point lower than for the population as a whole.

There is also the risk of acquiring an advanced degree, only to discover there is little demand for that specialty. In this report, the income for PhDs was lower than for "professional degree" holders. This shows the so-called "overeducation trap" — employers are reluctant to hire overqualified candidates, because they cost too much and they're likely to jump ship at word of a job for which they're actually qualified.

This article describes an "education bubble", not unlike the housing bubble where house prices kept rising but suddenly collapsed, and predicts that the education bubble will also burst, leaving many students with massive debt and little in the way of marketable skills. The article describes one particularly tragic story in which a student borrowed $100,000 to finance a degree in women's and religious studies, but who has recently realized there are no jobs with that description. And worse, it turns out that those saddled with impossible student debts find it very difficult to declare bankruptcy.

My advice? Students need to examine the job market realistically, find out which degrees are actually in demand, and avoid acquiring a degree that costs more than it's worth. As to the presumed ironclad connection between an advanced degree and future income, I remind my readers that many of the billionaire captains of high-tech industry are dropouts, including the four best-known — Bill Gates (Microsoft), Lawrence Ellison (Oracle), the recently deceased Steve Jobs (Apple), and Mark Zuckerberg (Facebook). In fact, here's a list of billionaire college dropouts (35 altogether). Billionaire Sir Richard Branson would have been included in this list, except that he isn't a college dropout — he's a high school dropout.

My reason for including the above paragraph is not to ridicule higher education, instead it is to ridicule higher schooling, especially the sort that fails to provide practical skills that pay off after graduation. Many of the people in the billionaire-dropout list dropped out only because they saw an opportunity for which their schools were unable to prepare them.

Insurance : "Insurance is a wise investment."

False! This widespread myth, aggressively promoted by investment counselors and investment banks, is simply false. Beyond some simple (and free) advice to balance one's portfolio and avoid too much concentration in any single sector, investment advice is either completely worthless or a net loss when costs are subtracted from gains.

This isn't just my opinion — the Wall Street Journal Dartboard Contest, an ongoing comparison of investment counselors' advice versus outcomes, comes to the same conclusion — "the performance of the pros [professional stock analysts] versus the Dow Jones Industrial Average [DJIA] was less impressive. The pros barely edged the DJIA by a margin of 51 to 49 contests. In other words, simply investing passively in the Dow, an investor would have beaten the picks of the pros in roughly half the contests (that is, without even considering transactions costs or taxes for taxable investors).". In other words, if you hired an investment counselor and paid his fees as well as transaction fees, you would lose out to a simple index fund (a fund that tracks a market index like the DJIA).

I have been giving this advice for years, and occasionally I hear from a student who thinks he sees a flaw in my reasoning. One such student recently wrote and pointed out that Berkshire Hathaway (Warren Buffett's fund), has beaten the DJIA and other indices for decades, "and why can't everyone do that?". My reply has multiple parts:

If the market is fair, if there is no large-scale cheating going on, and if the Efficient-Market Hypothesis is true, then equities are not predictable and a "winning system" is not possible. Therefore market averages represent a reasonable outcome for the average small investor, who should acquire a balanced "buy & hold" portfolio and sit on it.

But with millions of investors in the market, some of them will become wildly successful by chance alone (and others will do very badly by chance alone). In a computer simulation I showed that, for 100,000 investors, each with an initial stake of \$10,000 and random monthly trades over 20 years, and a make-believe market with stocks that randomly fluctuated up and down in price but gradually crept upward in price 12% per annum like the real market, 32% of the active investors came out ahead, 68% came out behind, and 224 millionaires were created by chance alone. (The passive "buy & hold" investors all came out ahead, with a gain of 11 times their initial stake.)

The above simulation shows that, in a fair market, success stories are more likely to result from chance than genius, but it must be very tempting to attribute one's own success to genius, regardless of a rigorous statistical analysis like this one. As a result, there are any number of people selling get-rich-quick books based on their personal experiences. Such books tend to be purchased by people who don't understand statistics or equities.

Well-known investment advisors can say accurately that their picks really do beat the market averages, but this is most likely the result of an "announcement effect" — the advisor has such a large following that, by announcing his market choices, he inspires many small advisors to make the same picks, which assures a rise in price — it's a self-fulfilling prophecy. The problem is one of timing — by the time an average investor hears about the picks and reacts, it's too late, the stocks have peaked in price and have begun to drop, which destroys any chance for an individual investor to realize a gain. But this system works just fine for the advisor, who is selling his position just as the small investors are buying theirs.

As to Berkshire Hathaway's record, it results to some extent from the "announcement effect" (investors know which stocks Warren Buffett invests in, so they invest and bid up those prices, usually at their expense, not his), and to some extent simple chance.

The bottom line is that, if there really was a winning strategy as is claimed in countless worthless investment books, it would quickly become public knowledge, everyone would practice it, and that would become the new market average. At that point, it would be deja vu all over again — investing in an index fund would produce better returns than having an investment advisor. And for the life of me, I can't understand why people don't realize this.

In conclusion, my advice is to take the free advice readily available on the Web, create a balanced portfolio including a "buy & hold" position in equities, and sit on it. Let the day traders lose their money, don't lose yours.

Economics : "A widening gap between rich and poor is unnatural and can only result from injustice"

False! Insurance nearly always favors the insurer's interests over the client, who, if he can afford it, should instead self-insure and invest the premiums himself. Here are the alternatives:

If the client buys insurance:

- The insurer takes the client's premium payments and invests them in ways that benefit only the insurer's stockholders.

- The insurer does all it can to avoid paying claims — by having a deductible amount (an amount below which the insurance company will not pay), and by thinking of all sorts of ingenious ways not to pay claims, most listed in the policy in endless pages of excruciatingly small print.

- By buying insurance, the client typically places himself in a risky group that may include (for car insurance) drunk and other unsafe drivers, insurance frauds who deliberately wreck cars they don't want any more, (for house and business insurance) people who may burn down their house or business solely to collect insurance, or (for health insurance) people who live unhealthy lives, who drink, who smoke cigarettes, who are overweight, and who get no exercise.

- The client has little incentive to protect the insured item — after all, it's insured, and if something happens to it, someone else pays (or so it seems).

If the client self-insures:

- The client puts what would have been premium payments into his own investments, from which he directly benefits over time.

- Then, if the insured item is lost or destroyed, the client pays for the loss from the investment proceeds, usually at a net gain.

- The client has every incentive to protect the insured item, based on the realization that if loss or damage should occur, he must pay directly.

There are only two good reasons to invest in insurance:

- The item was purchased with borrowed money and the lender requires insurance as a condition of the mortgage.

- The client cannot afford to replace the insured item and must have it.

In cases other than these, a person is better off self-insuring if he can afford to. But the truth is, for typical Americans who have no savings and who are deeply in debt, who have loans on their house and car, they have no choice about buying insurance — the lenders require it. But this is not an argument in favor of buying insurance, it only represents another negative side effect of a society riding in a sea of debt, and insurance represents another compelling reason not to borrow money.

If insurance were a reasonable investment, insurance companies would have marginal profits and be unattractive investments for stockholders. But in fact, because so much of insurance is required by lenders and because insurers set their own rates, the insurance business is very profitable — they collect premiums from clients, invest the premiums in ways that only benefit their own stockholders, and then do all they can to avoid paying claims.

In summary, for the same reason that borrowing money is a bad idea and should be avoided, it's clear that buying insurance is a bad idea and should be avoided if at all possible. In the mortgage example, a person borrows money he doesn't actually possess, and pays for the privilege. In the insurance example, a person borrows risk immunity he doesn't actually possess, and pays for the privilege. It's an exact parallel — no one borrows money he doesn't have to, and using the same reasoning, no one should buy risk immunity he doesn't have to. For the same reasons that possessing money is better than borrowing money, possessing risk immunity is better than borrowing risk immunity.Because of how it works, modern insurance represents one of the many ways that being poor makes you poorer (and being rich makes you richer), my next topic.

False! It is quite natural and difficult to avoid. But by calling it "natural" I'm not saying it's either fair or a "good thing" for society, I'm only saying that, unless measures are taken to prevent it, it happens naturally over time. And democracy, regardless of its other virtues, is not designed to prevent it, and cannot do so without specific policies in place.

The basic thesis of this section is that there are economic forces that naturally widen the gap between rich and poor — not discriminatory or unfair policies, but mathematical processes that are naturally unstable. Here's a classic example:

The InvestmentIn an imaginary, perfectly fair society, without discrimination based on race or gender, where everyone has access to the same opportunities, 20-year-old John Doe inherits \$20,000. He decides to place his inheritance in a long-term investment, hoping it will grow over time and provide for him when he gets old. John plans to let his investment run for 40 years, until he is 60. He also wants to draw a small amount of money from his investment every week, just for walking-around money, but (he hopes) in a way that won't drain the account. Here is the investment's description:

- Initial investment: \$20,000.00

- Investment period: 40 years.

- Interest rate: 12% per annum, compounded weekly.

- Desired weekly withdrawal amount: \$46.00

As described above, for a weekly withdrawal of \$46.00, the account's final balance will be \$20,000.00 — in other words, the \$46.00 withdrawals exactly match the accrued interest and the balance doesn't change. No surprises so far.

But here's the kicker — if John changes the amount withdrawn by a few pennies, the outcome changes radically — I mean radically. Here are some example outcomes:

- Again, as originally planned, John would withdraw \$46.00 per week and would end up with \$20,000.00 40 years later.

- If instead John withdraws \$46.38 per week, just 38 cents more (less than 1%), after 40 years the account is completely drained, balance \$0.00.

- If John withdraws \$45.61 per week, or 39 cents less, after 40 years the investment balance will have doubled, to \$40,000.00.

- But let's say John gets a job and doesn't need to withdraw \$46.00 per week, so he forgoes the income from his investment and lets it grow on its own. In this scenario, with no weekly withdrawals, during 40 years the investment will grow to about 2.4 million dollars!

The above compound-interest example is meant to reveal something most people don't know — investments and loans that involve compound interest naturally amplify small difference in wealth, and over time they naturally widen the gap between rich and poor. It isn't about fairness, it's about mathematics.

This explanation is not meant to excuse racism, sexism and every other unfair, discriminatory practice one finds in society — it's meant only to show that, if all those problems were solved and society became perfectly fair, over time there would still be a widening gap between rich and poor, simply because of (a) chance and (b) compound interest — natural forces.

Beyond compound interest, there are other natural forces that disfavor the poor. It turns out that being poor is naturally expensive — when a rich person buys a house, he just pays for it, all at once, while a poor person must sign a mortgage that over time may double the price of the house. It's the same with cars and other consumer goods — the poor pay more than the rich for the same goods, which can only make them poorer. In all areas of life — education, health care, recreation, planning for the future — being poor actually increases costs in a dozen different ways.

Here's a revealing rich/poor comparison — credit cards. When a poor person uses a credit card, in most cases he's adding to his existing debt load, and borrowing money at absurd interest rates (in some cases as high as 80%) that regular banks are prevented by law from demanding. And if the poor person falls behind in his credit card payments, the rates automatically go up, sometimes creating a descending whirlpool of debt the card holder can't escape. By contrast, when a rich person uses a credit card, because he doesn't have a continuing balance on his card he is in effect taking out a 30-day interest-free loan, a loan paid for by poor people (whose borrowing pays for the credit card system).

But that isn't the only rich/poor story, not by any means. In a shocking revelation, recent figures show that the richest 400 Americans, the so-called "Forbes 400", have more wealth than the poorest 60% of the entire population. Put another way, 400 people have more wealth than 180 million. This shocking fact about society results from two things:

- The natural consequences of compound interest.

- The unnatural consequences of unfair tax policies that protect wealth and the wealthy.

What do the rich think about this? In a recent New York Times opinion piece, billionaire Warren Buffett says he would be more than willing to pay more in taxes, and he regards the present system as unfair to most Americans. Buffett said, "My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice." Many of the rich have joined the Giving Pledge, a movement begun by Bill Gates and Warren Buffett that encourages the rich to give most of their wealth to charity instead of hoarding it and enriching their children. So far, about 100 very wealthy people have signed the pledge.

My point is that most of these people aren't stupid or politically backward — many understand the situation in which they find themselves, and contrary to popular belief, many openly disagree with the U.S. Congress on the issue of taxation of the wealthy, just as poor people do.

One reason for their outlook is an understanding of history — if the chasm between the rich and poor is allowed to increase unchecked, the middle class might disappear and that could have very serious consequences. As long as there's a middle class, poor people see a plausible route to self-improvement, an opportunity to rise. But without a middle class, poor people find themselves isolated below an impenetrable barrier with no way to escape. Because of that, it isn't the slightest exaggeration to say the middle class is the keystone to democracy and social stability.

Based on those forces, the U.S. stands between two extremes. One extreme is an oligarchy, a few rich people ruling the lives of many poor people, and no middle class. The other extreme is the kind of socialism that, by aggressively redistributing wealth, erases any incentive to innovate and excel, as well as increasing the size and power of government beyond any rational bounds. In my view, both these extremes are equally dangerous and neither should be allowed to come into existence. I have a joke about this, about the difference between oligarchy and socialism: under oligarchy, it's dog eat dog, but under socialism, it's the other way around.

Interestingly, at either unhealthy extreme (oligarchy or socialism) the middle class disappears, so in that sense, the presence of a middle class is a sign of social health. At the moment, ours is at risk.

Poor and middle-class people have more productive things they can do than resent the wealthy. Here are a few:

- First choice, get rid of your credit cards — cut them up and flush them down the toilet. Because of the harm they do, credit cards might as well be a plot against poor and middle-class people.

- Second choice — if you cannot do without credit cards (some transactions now require a credit card), then destroy all but one, and carefully monitor uses of that card.

- If you must have a credit card, then use it with ironclad discipline. Never allow a month-to-month balance to appear on your card. To assure this, carry a notepad while shopping and write down the cost of each purchase — when you get to the limit you can afford to pay to keep the card from carrying a month-to-month balance, stop shopping.

- While shopping for a house, car or other major purchase, if you're told that financing is available, start asking questions — how much will the financing costs add to the purchase price? Is there a penalty for paying off early? What happens if you miss a payment? And never sign a loan agreement that you don't fully understand.

- When you buy electronics, never buy the service plan the salesman always offers. Modern electronic devices are very reliable, and service plans are very rarely worth their cost — that's why you're always being asked to buy one.

- Go online and visit pages that suggest ways to save money — some of them are very useful. Here are some examples:

- Dumb Little Man — great site, terrible name.

- The Simple Dollar — many good tips.

- Let's Get Cheap — from BusinessWeek, a slide show with one money-saving tip per slide.

- Money Saving Tips — a pretty comprehensive collection.

Reader comments on this article — message page

Is Compound Interest Natural?Truck Braking Distance

| Home | | Articles | |  |  |  Share This Page Share This Page |